Recession-Era Unemployment

Well, just like that we are already higher in U.S. unemployment than the peak unemployment of the 2001-2002 recession. The Labor Department announced on Friday morning an absolutely dismal report of not only 240,000 jobs lost in October -- surely the single worst month for the U.S. economy in more than 25 years -- but also downward revisions to the number of jobs lost in August and September in the U.S. Combined with the revisions which added an additional 250,000 jobs lost during the prior two months, this brings the total jobs lost in the U.S. economy during just calendar year 2008 to a sickening 1.2 million. 1.2 million jobs fewer today than on December 31, 2007. Just think about what that means to the economy in this country (and think about how many more middle class jobs will have to be cut by big business if corporations have their taxes hiked). Anyone out there reading this, if you think your job is "safe", odds are siginficantly great that you are deluding yourself. Lord knows my job is at risk, as is the job of just about every one of the what, 12 million people sitting in their offices within a couple miles of me right now in New York City.

Looking back at recent history as a guide, the U.S. unemployment rate, which today spiked unexpectedly strongly to 6.5%, peaked at 6.4% in 2001, and now sits at its highest rate since March 1994. Anybody wondering how bad U.S. unemployment can typically get in good times, in "normal" recessions, and in the bad recessions? Well, I'm your guy. The internet is a wonderful thing.

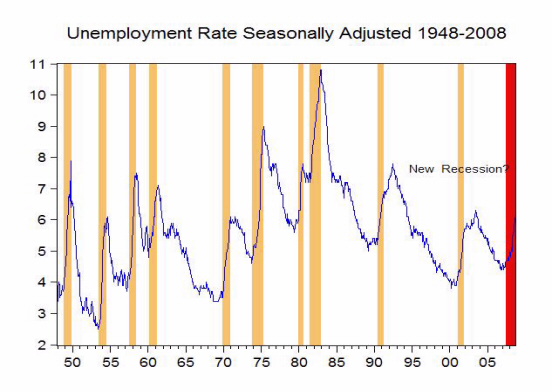

Here's the chart of historical unemployment rates, by percent of the measured workforce, which are reported monthly by Labor, going back to 1948. The vertical strips on the graph show the economic recessions superimposed on top of the unemployment rate chart below:

Now, as you can see from the chart above, using economists' generally-accepted definition of a recession as two consecutive quarters of shrinking U.S. GDP, there have been ten recessions that have occured since 1948, not counting the one the U.S. is currently in, which will be the 11th. Following are the peak unemployment rates, expressed as percentages, for each of those ten recessions:

1948-49: Oct 1949 7.1%.

1953-54: May 1954 5.9%

1957-58: Jul 1958 7.5%

1960-61: May 1961 7.1%

1969-70: Mar 1971 6.0%

1973-75: May 1975 9.0%

1980-80: Jul 1980 7.8%

1981-82: Dec 1982 10.8%

1990-91: Jun 1992 7.8%

2001-01: Jun 2003 6.3%

So, at 6.5%, we are already ahead of the peak unemployment rate in the brief and shallow recession following 9-11 in late 2001, although interestingly that peak did not occur until summer of 2003, well after the end of that particular recession. We are also ahead of the peak in the 1969-70 recession as well as the 1953-54 trough, both also regarded as relatively shallow recessions from a historical perspective. The Great Depression, not on these lists because the monthly unemployment figures were not officially measured and recorded until after World War II, is widely known to have featured the worst unemployment rates in U.S. history and is clearly the deepest, most sickening recession we have seen, with unemployment widely believed to have peaked just above 25% during 1933. But even with all the financial crisis business going on, there is no reason in my mind to believe we come anywhere remotely close to that level today. But this leaves a lot of room between 6.5% and 25% to try to figure where we land on the unemployment scale.

Assuming this is one of the more severe, deep recessions the U.S. experiences, as is widely believed and which I personally believe to likely be the case as well, we can look to the deeper recessions on the above list as a guideline to the likely landing point for U.S. unemployment. The two longest and deepest recessions in the U.S. measured by U.S. Gross Domestic Product since 1948 occurred in 1973-75 and 1981-82. This should not be surprising, as unemployment rates during those periods peaked at the highest points in the last 60 years as well during those two troughs, at 9.0% in May of 1975 and a whopping 10.8% in November and December of 1982. Those are hideous figures for sure, ones which would mean an increase in total unemployed persons in the U.S. by another 50% or so from current levels.

At this point in time, I can't (or don't want to) think of things getting quite that bad in the recession of 2008-2009. But in even the "normal" recessions -- the things I have written about here that happen with stark regularity as a natural effect of the economic cycles of capitalism -- unemployment has tended to peak somewhere north of 7%. That seems highly likely here. In fact, as this economic trough is likely to be more severe than your average recession, it seems logical to expect a higher than average number of unemployed Americans this time around. Looking at all those figures above, I think a final peak unemployment number of somewhere between 9 and 10% probably seems like a rational, reasonable expectation. As I mentioned, however, that is going to be a major mess for incoming President Barack Obama, as there are already 3.84 million Americans on long-term unemployment with the unemployment rate sitting at 6.1%. Raising that number to 5-6 million people out of work over the long term can only lead to hideosity for the national economy in the short term.

Which is why a story like this is so encouraging. Despite the stated goal of the left in this country to increase redistribution of wealth from the alleged "upper" class to the middle- and lower class, we are at least starting to see some senior Democrats acknowledging what I've been saying for a long time and was in fact calling for here just yesterday. Stimulating the economy needs to be Issue #1, 2, 3, 4 and 5 in the minds of the leadership of this country right now, and doing that certainly should not include tax hikes, not even on the richie riches of the world. Permanent tax cuts, on the other hand, now that's what I'm talkin about. Not because I want or need to have more money in my own pocket, but rather only because kick starting the economy is crucial for all the people of this country. Maybe Nancy Pelosi actually isn't the biggest fool of all time after all?

Labels: Economy, Obama, Recession, Unemployment

6 Comments:

Where was this Pelosi 100 days into her new position?

I guess Bush really was the Anti-Christ.

Well, this number isn't surprising to anyone who paid attention to the economy instead of listening to the talking heads and government cheerleaders all those months ago. 8% by the end of next year isn't unlikely, and anywhere from 9-11% by the end of 2010 wouldn't shock me either.

I've been telling everyone that the new year is going to get ugly once Christmas retail numbers are in, there's a whole chain reaction of events that will take place with how poor the numbers will be.

As for permanent tax cuts, what a joke. The US has a $10 TRILLION debt, and could run a deficit of $1 trillion soon. Cutting taxes makes about zero sense, as was proven time and again by the Bush administration. In these times, any savings from tax breaks will be put away, or used to pay the rent. Even if they did spur spending, it would be very temporary bubble that would result in... longer term pain.

I agree that raising taxes right now is a mistake, but somewhere down the road it HAS to happen to try and pull the country out of debt. Tax cuts only make sense when there's an equivalent amount of spending cuts, which the government is a LONG way from seeing.

Sadly, people are still clinging to a Keynesian model, not realizing that the model was broken after the tech boom. Massive government spending and rate cuts were used to spur the economy, and it worked. But the flipside is that in a boom, taxes and rates need to be raised, and spending cut... none of that happened, so now they're double-dipping in this bust, and it's not working.

Cutting taxes makes about zero sense, as was proven time and again by the Bush administration.

Astin, you are so wrong on this comment. Lowering taxes has always translated into higher tax revenues. Isn't that the purpose of taxing people? To raise revenue to cover government spending. Cutting taxes works when you do not increase spending. That is the biggest failure of the Bush administration. All the spending, not the tax cuts. That kept the economy going. The housing disaster- fueled by the Dems- has caused the crisis.

Sorry stb, I should have included "in this environment".

I agree that in calm economic times, and boom times, that tax cuts will increase revenue due to their effect of putting more money in the hands of people and corporations (and therefore the broader economy, which gets taxed). But in a time of contraction like we're seeing now, combined with the ridiculous amount of deficit spending, a tax cut will accomplish nothing.

The government has to get spending under control before even thinking of a tax cut, and that's not going to happen for a while. I imagine the Dems will look at increasing job-training, job-creation, and welfare programs to help the lower-class and unemployed. That costs more money. I imagine it will be balanced by various cuts, but it won't be enough to bring the deficit to a manageable level immediately.

We're years away from a stable economy and even further away from a booming one again, so in the meantime taxes should be held level. After that, I have no doubt Obama's plan to raise taxes on the upper-middle-class and wealthy will go into effect as a means of increasing revenues without draining from those who will be most affected by this downturn. Whether this is the right course of action or not is debateable, but it's the likely outcome.

THEN, once spending is under control, and the economy has balanced out, a tax cut will spur growth and spending again.

It just isn't as simple as "tax cuts spur spending", there are other factors that come into play, and none of them are valid right now. Trickle-down economics work when people are willing to spend, not when they're hoarding pennies.

I have to disagree with you again Astin. You want to cut taxes in a the turbulent times to encourage investment and spending. The new administration should embrace McCain's plan to cut corporate taxes. This will help create jobs and spending. It will also help keep prices under control.

Cutting taxes increases tax revenues. Worked for Bush, Reagan and Kennedy to get the economy out of the funks they were in.

stb - That's standard Keynesian theory, which is broken in this case.

Keyes advocated spending in infrastructure, lowering rates, and cutting taxes in turbulent downtimes so the government could replace corporations as a job creator and purchaser of goods.

But the theory also requires that once this phase is done, and the economy has recovered and is once again self-sufficient, that the government reverses these decisions and cuts spending, raises taxes, and raises rates in order to refill the coffers from the spending and cuts from the down period.

Phase 1 was implemented after the tech boom. Then it was exacerbated by 9/11. Once the economy got back on its feet, due to artificially low interest rates and a continued (yes, it started with the Dems, but the GOP continued it) push for easy credit and unfettered expansion, the other side didn't happen. The Bush administration continued to INCREASE spending, running a deficit, and at the same time cutting taxes and keeping rates low. They never refilled the vault.

So now the biggest credit bubble in history has burst, which creates the biggest credit crash. Returning to the first part of Keynesian theory now won't accomplish much at all, because the there's nothing behind it. You can't create money from nothing, which is what going that route would be trying to do.

Frankly, I cringe every time someone like Paulson talks about the need to grow the economy and continue expansion. It's just not feasible now. There HAS to be this contraction that the Fed has been fighting for years in order to create a more efficient marketplace. That means job losses, market turmoil, frugal consumer spending, and fiscal prudence.

Instead, the plan so far is to feed more money into the system at taxpayer cost. Sure, these measures may pay off down the road and actually MAKE money, but that doesn't help the here and now.

Cutting corporate taxes now will simply help profitable companies be more profitable. They won't hire, and they won't spend. At best, they'll let less people go. They're circling the wagons and running through their books to find savings and loopholes. Here's the thing - the companies that are suffering? The ones that are LOSING money? They won't be paying taxes this year anyway. You only pay taxes on profits, not losses.

Simply saying "tax cuts fix the economy" is far too simplistic.

Post a Comment

<< Home